While the need for sustainable development is great, it simply will not be possible for one government, firm, organization, or person to solve the infrastructure and development challenges of our society. Meeting these challenges will require a group effort.

An estimated $4.5 trillion in capital investment is needed every year in developing countries between now and 2030, according to the United Nations Global Goals for Sustainable Development (SDGs), which aim to end poverty, protect the planet, and advance the use of affordable, clean energy. The necessity for upgrading infrastructure in the developed world is also significant: In the United States alone, the funding gap for new infrastructure needs is an estimated $144 billion per year through 2025, according to the American Society of Civil Engineers.

Organizing the effort to meet the needs outlined in the SDGs is so daunting in its scale and complexity that the 17th and final goal is a call to arms for groups to work together to help transform the world. Partnerships, according to Goal 17, will need to be formed to achieve a successful sustainable development agenda. “These inclusive partnerships built upon principles and values, a shared vision, and shared goals that place people and the planet at the center, are needed at the global, regional, national and local level.”

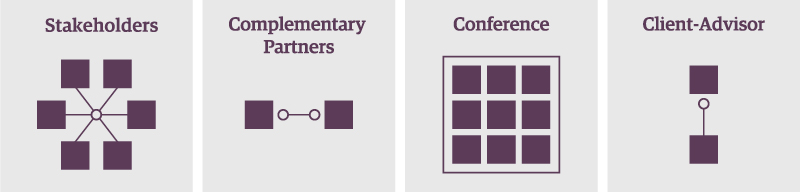

We are firm believers in the fundamental imperative of this goal. There are multiple ways in which these partnerships can develop and mobilize for action, and we have often joined with others to advance the cause of sustainability. We have seen a wide range of partnership models that can lead to tangible progress in meeting the sustainability needs of our world, but what they all have in common is that they convene like-minded stakeholders to align objectives, coordinate with various networks of specialists and interested parties, and share the responsibility to solve a specific challenge. In our experience, there are four basic models that have shown an ability to move a shared vision to a completed goal.

One model is for a large and diverse group of stakeholders to converge around an organizing entity for a single purpose. Our most notable experience in this model is in the effort to establish the Arctic Investment Protocol, which established the foundation for responsible development in the fast-changing Arctic Region. The Arctic Investment Protocol was the result of a multi-year effort organized by the World Economic Forum and crystallized by a 22-member council of concerned stakeholders, including academic institutions, think tanks, local and national governments, media outlets, Non-Governmental Organizations, businesses, trade organizations, and financial institutions. The result of our combined efforts in this project was a milestone in sustainable and responsible business practices, governance, and environmental stewardship.

Another model for partnerships forming in pursuit of shared goals is a smaller team of complementary partners that work together to complete a focused task. For example, in Guggenheim’s long-running partnership with the World Wildlife Fund, we have accomplished several tangible goals in sustainable development. Most recently, we came together to address the problem of measuring the efficacy of sustainable development efforts and developing tools that allow investors to assess the environmental impacts of infrastructure projects to determine their level of sustainability. To begin to address this challenge, Guggenheim Partners and WWF commissioned the Stanford Global Projects Center to identify and analyze the various metrics that have been established by multiple organizations to assess the sustainability of infrastructure investments. The purpose of the study is to assess the state of the practice for sustainability standards and rating or accounting systems for infrastructure investment. As the metric and reporting industry continues to develop in the sector, those specific indicators and metrics that emerge as international standards will enable wider adoption by a deeper range of institutional investors.

A third model for partnering to advance the cause of meeting the SDGs is when a loose confederation of like-minded entities converges around ideas that will open up engagement and lead to more targeted solutions. Call it the conference model: Conferences are very effective ways to provide this kind of platform in time and space, and the World Economic Forum is the leading example of how this works. Conferences provide deadlines, focus arguments, and foster planning and prioritization for future projects. Within the larger Davos gathering, we created the Goal 17 Partnerships event space to provide a diverse group of partners and stakeholders to come together for a vibrant discussion of shared concerns.

The fourth model is the client/provider model. In many instances a principal will find it necessary to hire an advisor, consultant, or contractor to achieve a goal that has a sustainability aspect. A builder may seek the services of a LEEDS consultant to certify a building, or a government may hire an engineering firm with an expertise in sustainable infrastructure to help plan a development so that it advances the region’s economic output while protecting the environment and the surrounding population. This model works is at work in the asset management business. We are seeing that it has become increasingly important to a growing number of clients and other stakeholders that Environmental, Social and Governance (ESG) factors are formalized in asset managers’ investment decisions. The partnership between client and asset manager will be an important tool in using the economic power of institutional investors to advance sustainability goals while insisting on generating an acceptable level of return. Each of the SDGs will require a commitment of financial resources to move to implementation, therefore this particular model of partnership is of utmost importance.

Like many firms and organizations with a commitment to supporting the UN’s SDGs, Guggenheim engages in a range of ways with a variety of other entities to advance the work. Openness to sharing financial, technological, and knowledge resources—in whatever partnership model works best—to address the complex sustainable development challenges facing our world is a fundamental feature of Goal 17. It is incumbent on all organizations to seek out partnerships, collaborations, and relationships that work for them so that their contributions can lead to a better world.

Important Notices and Disclosures

This material is distributed or presented for informational or educational purposes only and should not be considered a recommendation of any particular security, strategy or investment product, or as investing advice of any kind. This material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. The content contained herein is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation. Investing involves risk, including the possible loss of principal. Sustainability requirements, including environmental, social, and governance (ESG) obligations may limit available investments, which could hinder performance when compared to strategies with no such requirements.

Guggenheim Investments represents the investment management businesses of Guggenheim Partners, LLC ("Guggenheim"). Guggenheim Funds Distributors, LLC is an affiliate of Guggenheim.

Read a prospectus and summary prospectus (if available) carefully before investing. It contains the investment objective, risks charges, expenses and the other information, which should be considered carefully before investing. To obtain a prospectus and summary prospectus (if available) click here or call 800.820.0888.

Investing involves risk, including the possible loss of principal.

Guggenheim Investments represents the following affiliated investment management businesses of Guggenheim Partners, LLC: Guggenheim Partners Investment Management, LLC, Security Investors, LLC, Guggenheim Funds Distributors, LLC, Guggenheim Funds Investment Advisors, LLC, Guggenheim Corporate Funding, LLC, Guggenheim Wealth Solutions, LLC, Guggenheim Private Investments, LLC, Guggenheim Investments Loan Advisors, LLC, Guggenheim Partners Europe Limited, Guggenheim Partners Japan Limited, and GS GAMMA Advisors, LLC.

This is not an offer to sell nor a solicitation of an offer to buy the securities herein. GCIF 2019 and GCIF 2016 T are closed for new investments.

©

Guggenheim Investments. All rights reserved.

Research our firm with FINRA Broker Check.

• Not FDIC Insured • No Bank Guarantee • May Lose Value

This website is directed to and intended for use by citizens or residents of the United States of America only. The material provided on this website is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. All content has been provided for informational or educational purposes only and is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation. Investing involves risk, including the possible loss of principal.