/perspectives/macroeconomic-research/high-income-consumers-ai-investments-fuel-growth

Macroeconomic Update: High Income Consumers and AI Investments Fuel Growth

Housing, labor market, and lower income households face challenges.

U.S. economic growth found its footing after decelerating earlier this year, supported by a recovery in consumption and robust investment in AI. Reduced uncertainty and a rebound in financial markets helped consumption recover, particularly for high income households. AI-related investment has been a significant contributor to real GDP growth, even with official data likely understating the gains. Recent data looks relatively robust, prompting upward revisions to third-quarter GDP estimates.

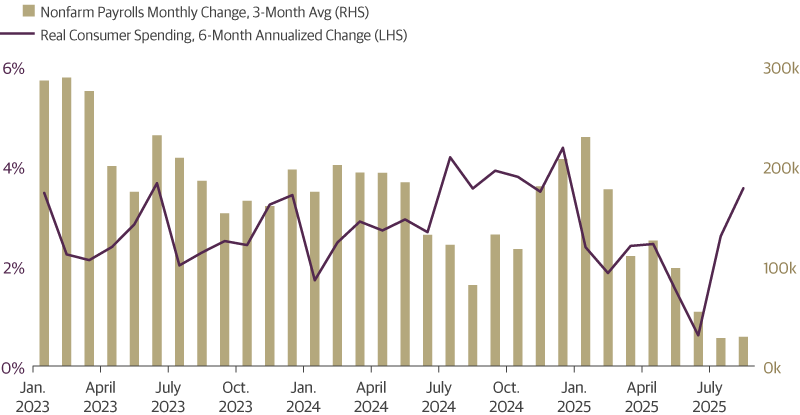

That said, the labor market remains a key risk, as job creation has slowed from a three-month average of 176,000 in January 2024 to just 29,000 by August 2025, with gains narrowly concentrated in healthcare and government sectors. Slower immigration and increased retirements have tempered the impact of weaker job growth, resulting in just a modest rise in the unemployment rate to 4.3 percent in August. We expect it to continue rising gradually to around 4.5 percent by year end, driven mainly by labor force entrants struggling to find jobs rather than widespread layoffs. Risks are skewed toward a sharper rise in unemployment, particularly as the conclusion of the government’s deferred resignation program at the end of September could add up to 150,000 federal layoffs.

Looking ahead, we expect growth to stabilize at around 1.7 percent in 2025 and maintain a similar pace in 2026, supported by fiscal measures under the One Big Beautiful Bill Act (OBBBA), which includes retroactive tax cuts that should lift personal tax refunds and provisions to broaden business investment. AI optimism and elevated asset prices are likely to sustain high-income household consumption, though the economy remains bifurcated. Housing and lower income households continue to face challenges, with depressed home sales, subdued housing investment, and rising credit card and student loan delinquencies.

Inflation is expected to remain above target through early 2026, driven by tariff passthrough effects, before resuming a disinflationary trajectory. While actual tariff collections have lagged tariff rates due to delayed implementation and corporate mitigation measures, the administration is closing loopholes. We expect continued gradual tariff pass-through into consumer prices but see these as one-time price adjustments rather than persistent inflation.

The Fed has is back in easing mode, implementing a “risk management” rate cut in September. While the prospect of above-target inflation remains a risk, Fed policymakers largely expect slower growth to weigh on inflation, and tariff pass-through to be temporary. Meanwhile, slightly higher unemployment has tilted risks to its dual mandate toward a softer labor market. We see the September rate cut as part of a recalibration, with one to two more cuts this year, and easing to neutral over the course of 2026.

Consumer Spending Has Recovered But Job Creation Remains Weak

Source: Guggenheim Investments, Bloomberg. Data as of 8.31.2025.

—By Matt Bush and Maria Giraldo

Important Notices and Disclosures

This material is distributed or presented for informational or educational purposes only and should not be considered a recommendation of any particular security, strategy or investment product, or as investing advice of any kind. This material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. The content contained herein is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

This material contains opinions of the authors, but not necessarily those of Guggenheim Partners, LLC or its subsidiaries. The opinions contained herein are subject to change without notice. Forward-looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable but are not assured as to accuracy. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information.

Investing involves risk, including the possible loss of principal. In general, the value of a fixed-income security falls when interest rates rise and rises when interest rates fall. Longer term bonds are more sensitive to interest rate changes and subject to greater volatility than those with shorter maturities. During periods of declining rates, the interest rates on floating rate securities generally reset downward and their value is unlikely to rise to the same extent as comparable fixed rate securities. Investors in asset-backed securities, including mortgage-backed securities and collateralized loan obligations (“CLOs”), generally receive payments that are part interest and part return of principal. These payments may vary based on the rate loans are repaid. Some asset-backed securities may have structures that make their reaction to interest rates and other factors difficult to predict, making their prices volatile and they are subject to liquidity and valuation risk. CLOs bear similar risks to investing in loans directly, such as credit, interest rate, counterparty, prepayment, liquidity, and valuation risks. Loans are often below investment grade, may be unrated, and typically offer a fixed or floating interest rate.

Guggenheim Investments represents the following affiliated investment management businesses of Guggenheim Partners, LLC: Guggenheim Partners Investment Management, LLC, Security Investors, LLC, Guggenheim Funds Distributors, LLC, Guggenheim Funds Investment Advisors, LLC, Guggenheim Partners Advisors, LLC, Guggenheim Corporate Funding, LLC, Guggenheim Partners Europe Limited, Guggenheim Partners Japan Limited, and GS GAMMA Advisors, LLC.

GPIM 66394

Tune in to Macro Markets to hear the top minds of Guggenheim Investments offer timely analysis on financial market trends. Guests include portfolio managers, fixed income sector heads, members of the Macroeconomic and Investment Research Group, and more.

Guggenheim Investments represents the investment management businesses of Guggenheim Partners, LLC ("Guggenheim"). Guggenheim Funds Distributors, LLC is an affiliate of Guggenheim.

Read a prospectus and summary prospectus (if available) carefully before investing. It contains the investment objective, risks charges, expenses and the other information, which should be considered carefully before investing. To obtain a prospectus and summary prospectus (if available) click here or call 800.820.0888.

Investing involves risk, including the possible loss of principal.

Guggenheim Investments represents the following affiliated investment management businesses of Guggenheim Partners, LLC: Guggenheim Partners Investment Management, LLC, Security Investors, LLC, Guggenheim Funds Distributors, LLC, Guggenheim Funds Investment Advisors, LLC, Guggenheim Corporate Funding, LLC, Guggenheim Wealth Solutions, LLC, Guggenheim Private Investments, LLC, Guggenheim Investments Loan Advisors, LLC, Guggenheim Partners Europe Limited, Guggenheim Partners Japan Limited, and GS GAMMA Advisors, LLC.

This is not an offer to sell nor a solicitation of an offer to buy the securities herein. GCIF 2019 and GCIF 2016 T are closed for new investments.

©

Guggenheim Investments. All rights reserved.

Research our firm with FINRA Broker Check.

• Not FDIC Insured • No Bank Guarantee • May Lose Value

This website is directed to and intended for use by citizens or residents of the United States of America only. The material provided on this website is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. All content has been provided for informational or educational purposes only and is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation. Investing involves risk, including the possible loss of principal.

By choosing an option below, the next time you return to the site, your home page will automatically

be set to this site. You can change your preference at any time.

We have saved your site preference as

Institutional Investors. To change this, update your

preferences.

United States Important Legal Information

By confirming below that you are an Institutional Investor, you will gain access to information on this website (the “Website”) that is intended exclusively for Institutional Investors and, as such, the information should not be relied upon by individual investors. This Website and any product, content, information, tools or services provided or available through the Website (collectively, the “Services”) are provided to Institutional Investors for informational purposes only and do not constitute a recommendation to buy or sell any security or fund interest. Nothing on the Website shall be considered a solicitation for the offering of any investment product or service to any person in any jurisdiction where such solicitation or offering may not lawfully be made. By accessing this Website, you expressly acknowledge and agree that the Website and the Services provided on or through the Website are provided on an as is/as available basis, and except as partnered by law, neither Guggenheim Investments and it parents, subsidiaries and affiliates nor any third party has any responsibility to maintain the website or the Services offered on or through the Website or to supply corrections or updates for the same. You understand that the information provided on this Website is not intended to provide, and should not be relied upon for, tax, legal, accounting or investment advice. You also agree that the terms provided herein with respect to the access and use of the Website are supplemental to and shall not void or modify the Terms of Use in effect for the Website. The information on this Website is solely intended for use by Institutional Investors as defined below: banks, savings and loan associations, insurance companies, and registered investment companies; registered investment advisers; individual investors and other entities with total assets of at least $50 million; governmental entities; employee benefit (retirement) plans, or multiple employee benefit plans offered to employees of the same employer, that in the aggregate have at least 100 participants, but does not include any participant of such plans; member firms or registered person of such a member; or person(s) acting solely on behalf of any such Institutional Investor.

By clicking the "I confirm" information link the user agrees that: “I have read the terms detailed and confirm that I am an Institutional Investor and that I wish to proceed.”