/perspectives/portfolio-strategy/2024-election-could-drive-fixed-income-performance

2024 Election Uncertainty Could Drive Fixed-Income Outperformance

Rising economic policy and geopolitical uncertainty may favor higher quality fixed income in this election year.

Report Highlights

- The S&P 500 typically performs better January-October in non-election years than in election years, and better in election years after the election is decided. Thus far, this year is atypical.

- We believe the market has yet to fully engage with the election narrative as there is usually more uncertainty over the nominees. But other uncertainties are waiting in the wings.

- The U.S. Economic Policy Uncertainty Index has averaged 17 percent higher in presidential election years than non-election periods, and this year promises to accelerate the recent trend.

- The 2024 election is also occurring in a period of high global geopolitical instability, as indicated by the Geopolitical Risk Index.

- In periods of heightened economic policy and geopolitical uncertainty, higher quality bonds tend to outperform equities and exhibit lower volatility.

- History also shows that we should not expect the Federal Reserve (Fed) to change its policy execution strategy because of the election, nor should we expect it to tip the scales one way or the other.

- With uncertainty likely to rise and the Fed expected to cut rates later this year, investors should consider increasing allocations to strategies invested in higher quality fixed income.

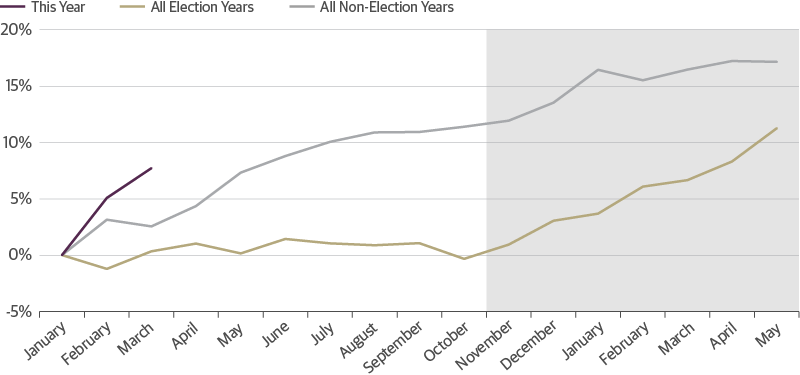

Election Year Equity Returns Typically Stay Subdued But Rise After November

Numerous studies have examined how risk assets fare in election years. Our analysis shows that presidential elections have weighed on risk assets in the months leading up to the election. Since 1985, the S&P 500 index has generally performed better between January and October in non-election years than in election years, with an average return of 12 percent in the former compared to less than 1 percent gain in the latter. The market performed better after the elections take place in November, as the removal of uncertainty has had a positive effect. This insight should help investors set realistic expectations for election years to strategize for potential volatility between January and November, and to understand the typically transient impact of elections on markets.

Equities Have Outperformed Their Typical Election Year Trajectory this Year

S&P 500 Performance During Election and Non-Election Years

Source: Guggenheim Investments, Bloomberg. Data as of 3.31.2024. Past performance does not guarantee future returns.

That said, this year is atypical. The S&P 500’s current year-to-date performance through January exceeds the typical trajectory for an election year, recording a 5 percent increase and setting new record highs. Absent additional context, the market appears poised to defy historical precedent and deliver strong gains despite a major election looming. It is possible that diminishing fears of a U.S. recession and anticipation of rate cuts are overshadowing the usual election-related uncertainties that tend to constrain risk assets.

We believe this year’s market performance can be explained by the inference that the market has yet to fully engage with the election narrative. At this point in a typical presidential election year, there is uncertainty over at least one of the candidates, and in a year in which there is no incumbent running, there is uncertainty over both. This is not the case in 2024. This year, it is highly likely that the election will be a rematch from 2020, and by all accounts the second Biden vs. Trump race will be as tight as the first contest.

In a rematch that feels like two incumbents running against each other, election year uncertainty over the nominees is missing, but other uncertainties are waiting in the wings. Once the market begins to focus on these election-related questions, the adjustment could be painful given several dynamics discussed below.

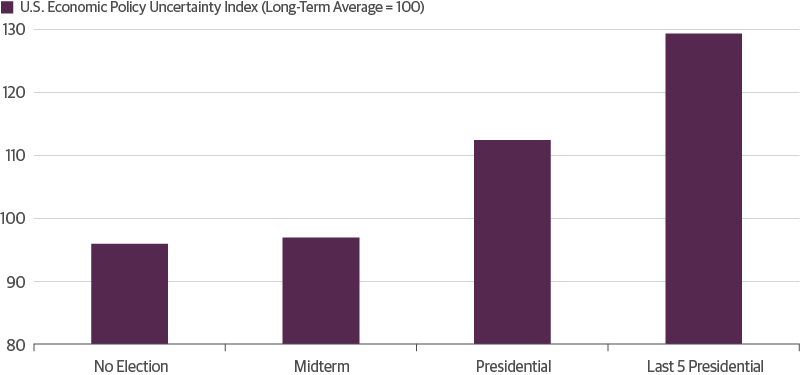

The Real Issue for Investors in 2024 Is Economic Policy Uncertainty

Policy uncertainty tends to rise during U.S. presidential election periods. If the executive branch transitions from one party to another, or stronger mandates are provided to the party in power, we often see substantial shifts in key policies, including taxation, healthcare, entitlements, and regulations. Since 1985, during U.S. presidential election years, the U.S. Economic Policy Uncertainty Index, which measures uncertainty related to economic policy based on media coverage, has averaged 17 percent higher relative to non-election periods. This trend has become even more pronounced over the past five elections, highlighting the potential for such uncertainty to reach unprecedented levels this year, especially given the upcoming election’s highly contentious nature and the deep polarization on policy issues.

Policy Uncertainty Tends to Rise During Presidential Elections

Economic policy uncertainty in election cycles since 1985

Source: Guggenheim Investments, Haver. Data as of 12.31.2023. The Economic Policy Uncertainty Index tracks geopolitical events and associated risks based on a tally of newspaper articles covering geopolitical tensions.

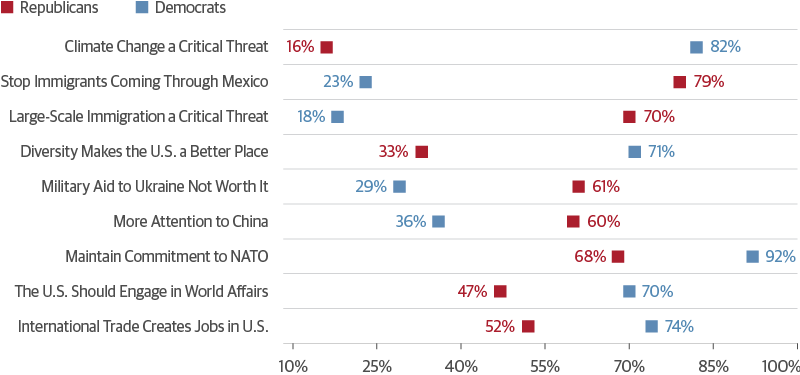

If anything, this year promises to accelerate the recent trend, as the country braces for an exceptionally close and rancorous election. President Biden faces an unusually challenging landscape, marked by the highest disapproval rating for a president entering an election year since President Carter in 1980. The growing hyperpolarization of the two major parties also highlights the stark policy disparities between Biden and Trump. The nearby chart shows how wide the gulf is between Democrat and Republican voters on key issues, which suggests possible abrupt shifts in policy expectations. Key issues at stake include U.S. engagement overseas, restrictions on trade and capital flows, immigration, support for Ukraine, and NATO commitments. Moreover, Trump’s legal entanglements and potential social unrest following the election will only add to the prevailing uncertainty.

Sharp Partisan Rift over Trade, Immigration, Foreign Relations, and Climate Issues Could Lead to Abrupt Policy U-Turns

Source: Guggenheim Investments, Chicago Council on Global Affairs. Data as of 12.31.2023.

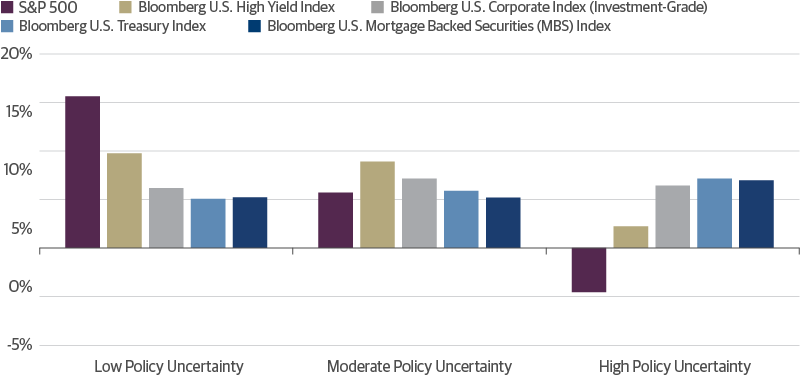

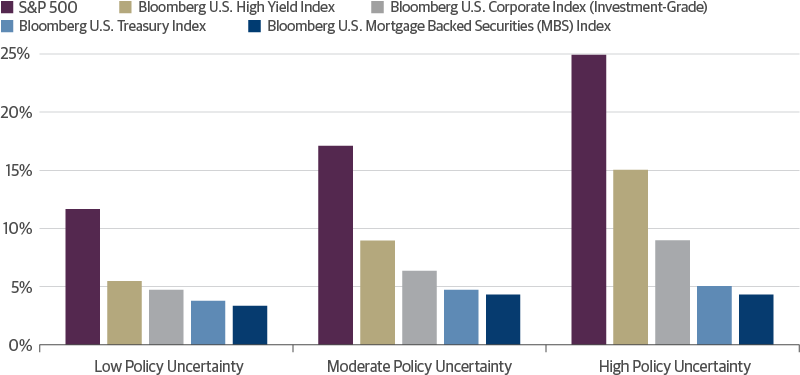

Higher Quality Fixed Income Outperformed in Periods of High Uncertainty

The policy gulf between the two candidates and parties should lead to more uncertainty. As of January 2024, however, the U.S. Economic Policy Uncertainty Index is below the average reading of historical presidential election years, and more importantly, well below the average reading of the five most recent presidential elections. When economic policy risk is low, risky assets like stocks and below investment-grade credit tend to perform best, which is consistent with the observed cross asset performance in U.S. markets over the last six and 12 months. However, during periods marked by heightened policy uncertainty, which we believe could characterize the next several months leading up to the election, higher quality bonds tend to outperform. Since 1986, in instances where the U.S. Economic Policy Uncertainty Index was more than one standard deviation above its mean, returns for U.S. Treasury securities and investment-grade corporate bonds were, on average, more than 10 percentage points greater than equities, which typically experienced negative returns.

Higher Quality Fixed Income Has Outperformed When Policy Uncertainty Is High

Economic policy uncertainty and asset class annualized returns since 1985

Source: Guggenheim Investments, Bloomberg, Haver. Data as of 12.31.2023. Past performance does not guarantee future returns.

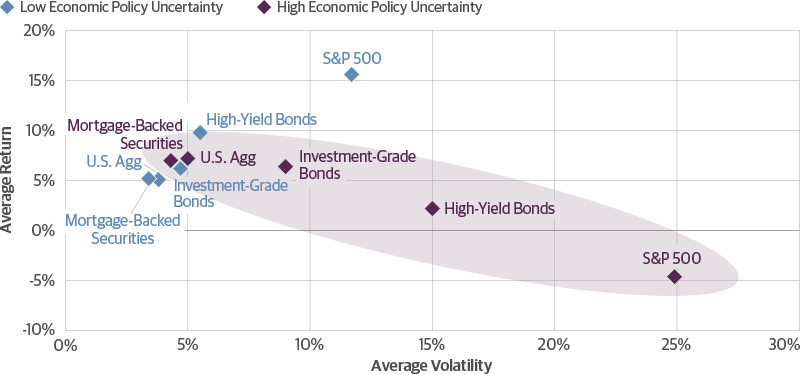

Moreover, we believe higher quality fixed income typically offers the most predictable returns when uncertainty over election outcomes and economic policies is high, based on standard deviation. In the same periods with elevated policy uncertainty, investment-grade corporate bonds and Treasurys not only demonstrated superior performance but also lower volatility. This outperformance of higher quality fixed income may indicate a preference among investors for more predictable returns in times when a clear view of future policies is elusive. Additionally, the lack of clarity around government policies can constrict the economy’s capital supply and increase friction in financial markets, ultimately exerting a drag on economic growth and returns of riskier assets.

Higher Quality Fixed Income Demonstrates Lower Volatility of Returns in Times of Unpredictability

Economic policy uncertainty and asset class annualized volatility since 1985

Source: Guggenheim Investments, Bloomberg, Haver. Data as of 12.31.2023. Past performance does not guarantee future returns.

In sum, during periods of higher economic policy uncertainty, higher quality fixed income has historically generated both higher returns and lower volatility.

Average Return vs. Average Volatility in Different Economic Policy Uncertainty Regimes

Source: Guggenheim Investments, Bloomberg, Haver. Data as of 12.31.2023. Past performance does not guarantee future returns.

Rising Geopolitical Uncertainty May Also Help Higher Quality Bonds

Beyond simmering domestic uncertainty in the United States, the forthcoming U.S. election is occurring in the context of growing global geopolitical instability. For instance, bipartisan animosity towards China may prompt both parties to harden their positions. When combined with a new hardline Taiwanese president aiming to secure stronger U.S. security guarantees, this situation could lead to a standoff between the United States and China in the Taiwan Strait. Furthermore, the razor thin margins in the presidential campaign create an opportunity for foreign countries to capitalize on Biden’s vulnerabilities in the leadup to the election. Iran might use Biden’s reluctance for escalation to counteract the bolstering of U.S.-Israel security cooperation against Tehran, potentially orchestrating attacks through proxies. Similarly, Russia could exploit Biden’s concern over energy costs by weaponizing oil and gas to weaken the Democrats, aiming to diminish U.S. support for Ukraine.

The interplay between domestic electoral dynamics and international strategic maneuvers underscores the multifaceted challenges facing U.S. economic policy and national security. Any geopolitical upheavals, particularly in oil production or chip supply chains, could profoundly destabilize the U.S. and global economies. Again, an environment with elevated geopolitical risks, as indicated by the news coverage-based Economic Policy Uncertainty Index, may also favor investment-grade corporate bonds and U.S. Treasurys.

Geopolitical Tensions Generally Weigh on Riskier Assets

Geopolitical uncertainty* and asset returns (annualized six-month trailing %)

Source: Guggenheim Investments, Bloomberg, Haver. Data as of 12.31.2023. *The Economic Policy Uncertainty Index tracks geopolitical events and associated risks based on a tally of newspaper articles covering geopolitical tensions. Past performance does not guarantee future returns.

Investment Implications

As we approach the presidential election in November, the unveiling of candidates’ political agendas could introduce a layer of uncertainty that has the potential to affect market performance, particularly for riskier assets that tend to falter amid heightened economic policy uncertainty. Failing to account for the unique and competitive nature of this election cycle might result in inadequate asset allocation in investment portfolios, overweighting unnecessary risk and missing out on the advantages of diversification. With policy risk set to rise and the Fed expected to cut rates later this year, investors should consider increasing allocations to strategies invested in higher quality fixed income, given its track record of outperformance during periods of elevated uncertainty.

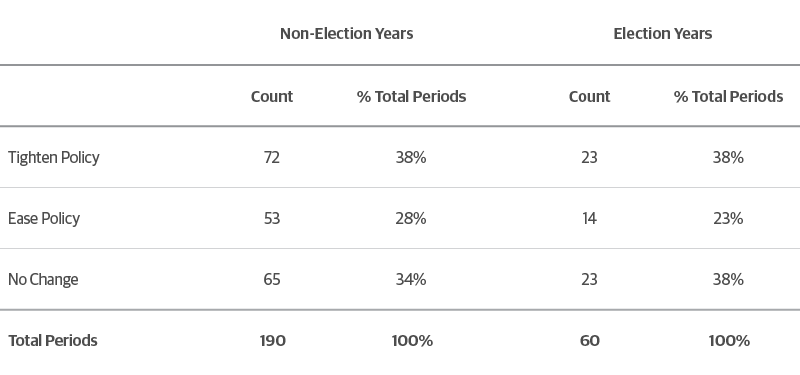

Dispelling the Myth that the Fed Abstains from Policy Moves During Presidential Election Years

Election years often bring concerns that the Fed would refrain from making significant policy moves. After all, the Fed is politically independent and a rate hike or rate cut could carry implications of a political motive. History shows that this is not the case. Indeed, the Fed has adjusted policy at a similar frequency and in similar directions in election years and non-election years.

Quarterly Fed Policy Moves During Election and Non-Election Years

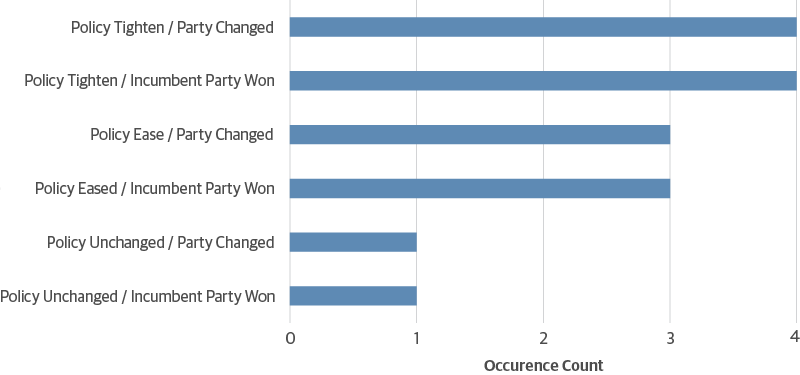

Zooming in on just presidential election years, the Fed has also shown no particular disinclination to make a monetary policy change. Indeed, the Fed has moved rates during 14 of the last 16 presidential elections since 1956. Perhaps more importantly, these changes have not made a difference to the outcome. In a year in which the Fed is expected to cut rates, we should not expect the Fed to change its policy execution strategy because of the election, nor should we expect it to tip the scales one way or the other.

Election Year Fed Moves in Last 16 Presidential Elections

Source: Guggenheim Investments, Bloomberg, Britannica.com. Data beginning 1956 and as of 12.31.2023.

Research and analysis provided by Jerry Cai, Maria Giraldo, and Paul Dozier of the Macroeconomic and Investment Research Group.

Important Notices and Disclosures

Investing involves risk, including the possible loss of principal. In general, the value of a fixed-income security falls when interest rates rise and rises when interest rates fall. Longer term bonds are more sensitive to interest rate changes and subject to greater volatility than those with shorter maturities. During periods of declining rates, the interest rates on floating rate securities generally reset downward and their value is unlikely to rise to the same extent as comparable fixed rate securities. High yield and unrated debt securities are at a greater risk of default than investment grade bonds and may be less liquid, which may increase volatility. Investors in asset-backed securities, including mortgage-backed securities and collateralized loan obligations (“CLOs”), generally receive payments that are part interest and part return of principal. These payments may vary based on the rate loans are repaid. Some asset-backed securities may have structures that make their reaction to interest rates and other factors difficult to predict, making their prices volatile and they are subject to liquidity and valuation risk. CLOs bear similar risks to investing in loans directly, such as credit, interest rate, counterparty, prepayment, liquidity, and valuation risks. Loans are often below investment grade, may be unrated, and typically offer a fixed or floating interest rate.

The Bloomberg U.S. Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD-denominated securities publicly issued by U.S. and non-U.S. industrial, utility, and financial issuers. The Bloomberg U.S. Corporate High Yield Bond Index measures the USD-denominated non-investment grade, fixed-rate, taxable corporate bonds. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Bal/BB+/BB+ or below. The index excludes emerging market debt. The S&P 500 Index is a capitalization weighted index of 500 stocks, actively traded in the U.S, designed to measure the performance of the broad economy, representing all major industries. The Bloomberg U.S. Treasury Index measures U.S. dollar-denominated, fixed-rate, nominal debt issued by the U.S. Treasury with remaining maturity of at least one year. The Bloomberg U.S. Mortgage Backed Securities (MBS) Index tracks fixed-rate Agency mortgage backed pass-through securities guaranteed by Ginnie Mae (GNMA), Fannie Mae (FNMA), and Freddie Mac (FHLMC).

This material is distributed or presented for informational or educational purposes only and should not be considered a recommendation of any particular security, strategy or investment product, or as investing advice of any kind. This material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. The content contained herein is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

This material contains opinions of the author, but not necessarily those of Guggenheim Partners, LLC or its subsidiaries. The opinions contained herein are subject to change without notice. Forward looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information. No part of this material may be reproduced or referred to in any form, without express written permission of Guggenheim Partners, LLC.

Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy or, nor liability for, decisions based on such information.

© 2024, Guggenheim Partners, LLC. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Guggenheim Partners, LLC. Guggenheim Funds Distributors, LLC is an affiliate of Guggenheim Partners, LLC. For information, call 800.345.7999 or 800.820.0888.

60648

Tune in to Macro Markets to hear the top minds of Guggenheim Investments offer timely analysis on financial market trends. Guests include portfolio managers, fixed income sector heads, members of the Macroeconomic and Investment Research Group, and more.

Guggenheim Investments represents the investment management businesses of Guggenheim Partners, LLC ("Guggenheim"). Guggenheim Funds Distributors, LLC is an affiliate of Guggenheim.

Read a prospectus and summary prospectus (if available) carefully before investing. It contains the investment objective, risks charges, expenses and the other information, which should be considered carefully before investing. To obtain a prospectus and summary prospectus (if available) click here or call 800.820.0888.

Investing involves risk, including the possible loss of principal.

Guggenheim Investments represents the following affiliated investment management businesses of Guggenheim Partners, LLC: Guggenheim Partners Investment Management, LLC, Security Investors, LLC, Guggenheim Funds Distributors, LLC, Guggenheim Funds Investment Advisors, LLC, Guggenheim Corporate Funding, LLC, Guggenheim Wealth Solutions, LLC, Guggenheim Partners Europe Limited, Guggenheim Partners Japan Limited, GS GAMMA Advisors, LLC, and Guggenheim Private Investments, LLC.

This is not an offer to sell nor a solicitation of an offer to buy the securities herein. GCIF 2019 and GCIF 2016 T are closed for new investments.

©

Guggenheim Investments. All rights reserved.

Research our firm with FINRA Broker Check.

• Not FDIC Insured • No Bank Guarantee • May Lose Value

This website is directed to and intended for use by citizens or residents of the United States of America only. The material provided on this website is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. All content has been provided for informational or educational purposes only and is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation. Investing involves risk, including the possible loss of principal.

By choosing an option below, the next time you return to the site, your home page will automatically

be set to this site. You can change your preference at any time.

We have saved your site preference as

Institutional Investors. To change this, update your

preferences.

United States Important Legal Information

By confirming below that you are an Institutional Investor, you will gain access to information on this website (the “Website”) that is intended exclusively for Institutional Investors and, as such, the information should not be relied upon by individual investors. This Website and any product, content, information, tools or services provided or available through the Website (collectively, the “Services”) are provided to Institutional Investors for informational purposes only and do not constitute a recommendation to buy or sell any security or fund interest. Nothing on the Website shall be considered a solicitation for the offering of any investment product or service to any person in any jurisdiction where such solicitation or offering may not lawfully be made. By accessing this Website, you expressly acknowledge and agree that the Website and the Services provided on or through the Website are provided on an as is/as available basis, and except as partnered by law, neither Guggenheim Investments and it parents, subsidiaries and affiliates nor any third party has any responsibility to maintain the website or the Services offered on or through the Website or to supply corrections or updates for the same. You understand that the information provided on this Website is not intended to provide, and should not be relied upon for, tax, legal, accounting or investment advice. You also agree that the terms provided herein with respect to the access and use of the Website are supplemental to and shall not void or modify the Terms of Use in effect for the Website. The information on this Website is solely intended for use by Institutional Investors as defined below: banks, savings and loan associations, insurance companies, and registered investment companies; registered investment advisers; individual investors and other entities with total assets of at least $50 million; governmental entities; employee benefit (retirement) plans, or multiple employee benefit plans offered to employees of the same employer, that in the aggregate have at least 100 participants, but does not include any participant of such plans; member firms or registered person of such a member; or person(s) acting solely on behalf of any such Institutional Investor.

By clicking the "I confirm" information link the user agrees that: “I have read the terms detailed and confirm that I am an Institutional Investor and that I wish to proceed.”