/perspectives/portfolio-strategy/fixed-income-is-now-a-buyers-market

Fixed Income Is Now a Buyer’s Market

Improved value proposition in credit.

June 01, 2023

| By Steve Brown, CFA, Chief Investment Officer, Total Return and Macro Strategies

The tightening cycle has brought about a regime shift that we believe is likely to continue to benefit fixed-income investors for the foreseeable future. The era of low levels of interest rates and borrowing terms favoring shareholders over lenders seems behind us. The subsequent recapturing of economics and negotiating leverage by creditors is just beginning. The shift in this dynamic, combined with wide spreads and higher yields, has dramatically improved the value proposition of credit investments.

Last year's selloff was mostly technical in nature, driven by the radical changes in the level and shape of the yield curve, and it spared virtually no sector. Now disparate fundamental trends are taking center stage, which means we are likely to see more dispersion in returns across sectors, industries, and ratings. If our view is correct that the Fed’s tightening cycle is essentially over, the future trend of rates could become more one-sided.

Investment-grade and high-yield corporate bond yields are off the highs from 2022, but they are still at levels we haven't seen since 2009/2010. Investment-grade bonds are yielding over 5 percent and high-yield bond yields are over 8 percent on average, according to the Bloomberg U.S. Investment-Grade Corporate Index and the ICE BofA High-Yield index, respectively. The inverted yield curve is driving meaningful opportunities to diversify portfolios across sector and duration profile, particularly in investment-grade floating rate assets, and namely structured credit.

U.S. Investment-Grade and High-Yield Corporate Bond Yields

Source: Guggenheim Investments, Bloomberg U.S. Investment-Grade Corporate Index, ICE BofA U.S. High-Yield Index. Data as of 5.23.2023

The uncertainty related to this hiking cycle, which is now handing off to uncertainty related to the severity of a potential recession, has created a similar story in credit spreads (the difference in yield between credit sectors and Treasurys). High grade spreads are on the wide side of their own history, and investment-grade securitized credit is particularly attractive with spreads having been wider only 20–30 percent of the time dating back to pre-2008 financial crisis.

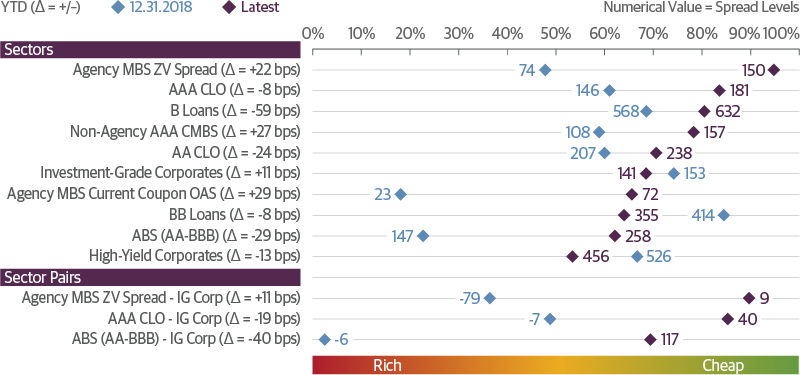

Comparing to a similar point in history in 2018 when fears of overtightening caused the Fed to pause its rate-hiking cycle, yields are significantly higher now and spreads are wider in most sectors, as shown in our chart. Like 2018, the Fed has vowed to continue with quantitative tightening. But the fundamental picture is arguably better today. Net leverage is lower and interest coverage is higher across most rating categories relative to prior downturns, due to strong nominal profit growth and lower interest expense. Balance sheet liquidity, while not evenly distributed, remains robust at the index level with high cash-to-debt ratios.

Many Credit Sectors Are Still at the Wide End of Historical Ranges

Fixed-Income Spread Percentiles (% of Time Spent at or Below Current Spreads Historically)

Source: Guggenheim Investments. Credit Suisse, Bloomberg, ICE BofA. Data as of 5.23.2023. Index Legend: Credit Suisse Leveraged Loan Index, Credit Suisse High-Yield Corporate Bond Index, Bloomberg Investment-Grade Corporate Bond Index, Bloomberg U.S. Aggregate Index (Agency bond subset), Historical CLO spreads provided by Bank of America Research, current CLO spreads based on JP Morgan CLOIE Index, Non-Agency CMBS spreads provided by JP Morgan Research, ICE BofA AA-BBB U.S. Asset-Backed Securities.

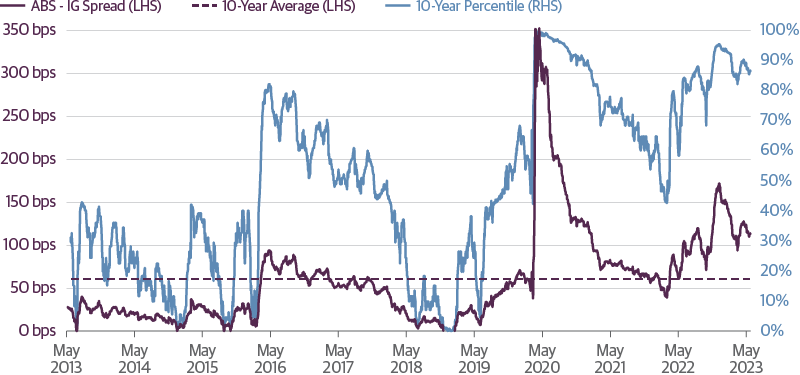

The spread between investment-grade securitized credit and similarly rated corporate credit has also rarely been wider. Structured credit excess yields exist, in part, because of the sector’s complexity premium, and that premium today is pronounced. Therefore, the value in high grade credit is not just a yield story, but one of adequate risk premiums that compensate for credit risk and offer an opportunity to monetize complexity.

Structured Credit Spreads Remain Wide to Investment-Grade Corporates

10-Year Trailing: IG ABS vs IG Corporate Spread

Source: Guggenheim Investments, Bloomberg. Data as of 5.23.2023. IG Corporate index is the ICE BofA US Corporate Index. IG ABS index is the ICE BofA AA-BBB US ABS Index. There are four days in March 2020 and one day in April 2020 where the spread differential exceeded 350 basis points; these data points are hidden from the graph but are included in the percentile and average calculations.

We believe that the credit sector in the aggregate has the strength to weather a potential recession that could come as soon as the second half of this year. However, the credit markets are likely to be in for a longer period of heightened idiosyncratic risk where deep fundamental analysis and credit selection will be key. Among many idiosyncratic credit concerns ahead are debt maturity and refinancing risks, which vary greatly across issuers and industries, but other factors could trigger defaults as evidenced by the turmoil among regional banks this year.

The experience in the banking system this year caused significant dispersion, or market differentiation, in spreads of different finance companies and banks, with tiering between large and small issuers and within capital structures. However, we have not yet seen the same kind of pronounced dispersion in other industries, and there is still limited credit tiering within rating categories. We believe this will change over time and investors will need to be on alert for those firms that will underperform due to cyclical or other reasons. The dispersion in bank credit this year demonstrated just how quickly this tiering can happen, and it serves as a good reminder of the importance of diversification within industries and across sectors.

With today’s heightened uncertainty, now is the time to prioritize quality. Quality can take many forms, including sector preference, seniority in capital structure, and prioritizing certain lending terms. The good news is that a defensive posture does not mean sacrificing returns because of the negotiating leverage of creditors and the attractive yields and spreads available, particularly in high grade, underfollowed categories of credit. We believe that for most sectors, there is enough excess spread to compensate for potential costs of rising credit risk.

Our portfolio allocations are shifting to reflect the up-in-quality playbook. We are using market strength as an opportunity to rotate, seeking diversification and adding structured credit exposure that we find attractive. Higher yields at the short end of the curve have lowered the opportunity cost of short-term investments; building our allocation to such holdings not only maintains our return profile, but it also provides the necessary dry powder for us to become a source of opportunistic capital at the appropriate time.

Important Notices and Disclosures

Dry powder refers to highly liquid assets, such as cash or money market instruments, that can be invested when more attractive investment opportunities arise.

This material is distributed or presented for informational or educational purposes only and should not be considered a recommendation of any particular security, strategy or investment product, or as investing advice of any kind. This material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. The content contained herein is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

This material contains opinions of the authors, but not necessarily those of Guggenheim Partners, LLC or its subsidiaries. The opinions contained herein are subject to change without notice. Forward-looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable but are not assured as to accuracy. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information.

Investing involves risk, including the possible loss of principal. Investments in fixed-income instruments are subject to the possibility that interest rates could rise, causing their values to decline. High yield and unrated debt securities are at a greater risk of default than investment grade bonds and may be less liquid, which may increase volatility. Investors in asset-backed securities, including mortgage-backed securities and collateralized loan obligations (“CLOs”), generally receive payments that are part interest and part return of principal. These payments may vary based on the rate loans are repaid. Some asset-backed securities may have structures that make their reaction to interest rates and other factors difficult to predict, making their prices volatile and they are subject to liquidity and valuation risk. CLOs bear similar risks to investing in loans directly, such as credit, interest rate, counterparty, prepayment, liquidity, and valuation risks. Loans are often below investment grade, may be unrated, and typically offer a fixed or floating interest rate.

Guggenheim Investments represents the investment management businesses of Guggenheim Partners, LLC ("Guggenheim"). Securities offered through Guggenheim Funds Distributors, LLC.

©2023, Guggenheim Partners, LLC. All Rights Reserved. No part of this document may be reproduced, stored, or transmitted by any means without the express written consent of Guggenheim Partners, LLC.

GPIM 57497

VIDEOS AND PODCASTS

Maria Giraldo, Investment Strategist for Guggenheim Investments, joins Asset TV’s Fixed Income Masterclass.

It’s been 10 months since the Fed’s last rate hike and Evan Serdensky, Portfolio Manager on our Total Return team, and Matt Bush, our U.S. Economist, join Macro Markets to discuss what’s next for the economy and markets.

Guggenheim Investments represents the investment management businesses of Guggenheim Partners, LLC ("Guggenheim"). Guggenheim Funds Distributors, LLC is an affiliate of Guggenheim.

Read a prospectus and summary prospectus (if available) carefully before investing. It contains the investment objective, risks charges, expenses and the other information, which should be considered carefully before investing. To obtain a prospectus and summary prospectus (if available) click here or call 800.820.0888.

Investing involves risk, including the possible loss of principal.

*Assets under management is as of 6.30.2024 and includes leverage of $15.1bn. Guggenheim Investments represents the following affiliated investment management businesses of Guggenheim Partners, LLC: Guggenheim Partners Investment Management, LLC, Security Investors, LLC, Guggenheim Funds Distributors, LLC, Guggenheim Funds Investment Advisors, LLC, Guggenheim Corporate Funding, LLC, Guggenheim Partners Europe Limited, Guggenheim Partners Japan Limited, and GS GAMMA Advisors.

This is not an offer to sell nor a solicitation of an offer to buy the securities herein. GCIF 2019 and GCIF 2016 T are closed for new investments.

©

Guggenheim Investments. All rights reserved.

Research our firm with FINRA Broker Check.

• Not FDIC Insured • No Bank Guarantee • May Lose Value

This website is directed to and intended for use by citizens or residents of the United States of America only. The material provided on this website is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. All content has been provided for informational or educational purposes only and is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation. Investing involves risk, including the possible loss of principal.

By choosing an option below, the next time you return to the site, your home page will automatically

be set to this site. You can change your preference at any time.

We have saved your site preference as

Institutional Investors. To change this, update your

preferences.

United States Important Legal Information

By confirming below that you are an Institutional Investor, you will gain access to information on this website (the “Website”) that is intended exclusively for Institutional Investors and, as such, the information should not be relied upon by individual investors. This Website and any product, content, information, tools or services provided or available through the Website (collectively, the “Services”) are provided to Institutional Investors for informational purposes only and do not constitute a recommendation to buy or sell any security or fund interest. Nothing on the Website shall be considered a solicitation for the offering of any investment product or service to any person in any jurisdiction where such solicitation or offering may not lawfully be made. By accessing this Website, you expressly acknowledge and agree that the Website and the Services provided on or through the Website are provided on an as is/as available basis, and except as partnered by law, neither Guggenheim Investments and it parents, subsidiaries and affiliates nor any third party has any responsibility to maintain the website or the Services offered on or through the Website or to supply corrections or updates for the same. You understand that the information provided on this Website is not intended to provide, and should not be relied upon for, tax, legal, accounting or investment advice. You also agree that the terms provided herein with respect to the access and use of the Website are supplemental to and shall not void or modify the Terms of Use in effect for the Website. The information on this Website is solely intended for use by Institutional Investors as defined below: banks, savings and loan associations, insurance companies, and registered investment companies; registered investment advisers; individual investors and other entities with total assets of at least $50 million; governmental entities; employee benefit (retirement) plans, or multiple employee benefit plans offered to employees of the same employer, that in the aggregate have at least 100 participants, but does not include any participant of such plans; member firms or registered person of such a member; or person(s) acting solely on behalf of any such Institutional Investor.

By clicking the "I confirm" information link the user agrees that: “I have read the terms detailed and confirm that I am an Institutional Investor and that I wish to proceed.”