About Unit Investment Trusts

Unit investment trusts (UITs) can be a powerful way for investors to gain exposure to timely opportunities as part of their overall investment plan.

From broad-based strategies to more niche market segments, Guggenheim Investments offers professionally selected portfolios that provide access to asset classes, investment styles, and market sectors in a single transaction.

Like traditional mutual funds and exchange traded funds (ETFs), UITs are packaged investment products offering daily liquidity, while providing investors with the opportunity to own a transparent and fully invested1 basket of securities.

A Unique Investment Structure

UITs can potentially function as an effective complement to a well-balanced portfolio.

| |

UITs |

ETFs |

Mutual Funds |

Individual Securities |

| Portfolio transparency |

■ |

■ |

|

■ |

| Professional selection |

■ |

■ |

■ |

|

| Fully invested2 |

■ |

■ |

|

|

| Daily liquidity3 |

■ |

■ |

■ |

■ |

| Potential for diversification4 |

■ |

■ |

■ |

|

| Relatively lower average annual operating expenses |

■ |

■ |

|

Not applicable |

| Actively managed portfolio |

|

■ |

■ |

|

■ Security has these attributes □ Only actively managed ETFs have these attributes

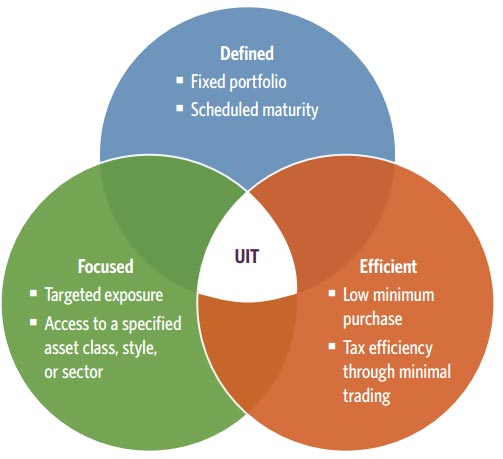

Defined

The defined nature of UITs may make them an effective strategy to align with investment objectives. The portfolio is transparent and generally remains fixed for the life of the trust. Investors know exactly what they own for the duration of the investment.

This defined approach ensures that UITs do not experience style drift. A UIT portfolio is not typically impacted by unnecessary trading driven by emotional reactions to market movements.

Focused

The UIT provides access to a specified asset class, investment style, or sector through a diversified4 basket of securities.

Typically more concentrated than other packaged investments, the UIT structure seeks to deliver targeted exposure, which may serve to enhance return potential.

Efficient

Through one relatively low minimum purchase, investors can own a portfolio of professionally selected securities, which are monitored on a continuous basis. In addition, due to their defined nature and structure, UITs may also offer a degree of tax efficiency.

Upon maturity of a UIT, investors have several distribution options, which include rolling the maturing proceeds into the same or similar strategy, receiving the cash value of the trust units, or requesting an in-kind distribution of the trust’s underlying securities.5

Guggenheim Expertise

Guggenheim manages a broad UIT lineup, offering more than 50 products, covering a variety of asset classes and investment themes. We provide equity and multi-asset UITs, as well as fixed-income options that include taxable, municipal, and buffered strategies. Our investment teams are committed to analyzing and identifying attractive opportunities across global markets. We seek to advance the strategic needs of our clients by delivering timely strategies with high conviction, while assessing risk at the security, sector, and portfolio composition levels.

Additional UIT Resources

Transparency, convenience, professional selection and supervision. UITs offer investors many benefits in a single packaged investment.

Advantages of UITs

UITs can be a powerful way for investors to gain exposure to timely opportunities as part of their overall investment plan.

UIT Frequently Asked Questions

The characteristics described above represent general attributes of typical investments of the types indicated. Specific investments may have different characteristics. Please consult a prospectus. ETFs refer to typical exchanged traded funds structures as open-end funds or investment trusts. Mutual funds refer to typical open-ended funds.

1 Please note that UITs may hold limited cash positions.

2 Unit trusts and ETFs may periodically hold limited cash positions.

3 Investment return and principal value will fluctuate and units, when redeemed, may be worth more or less than what you paid. Individual securities and ETFs may be purchased and sold throughout each business day while mutual fund shares and trust units may be purchased and redeemed based upon prices determined as of the close of business each business day.

4 Diversification does not ensure a profit or eliminate the risk of loss. Please note that select UITs are specific to an asset class, sector, etc.

5 Certain requirements must be met for an in-kind distribution of the trust’s underlying securities to be requested. Please note that this option excludes foreign securities. Please see each trust’s prospectus for more information on your options.

Risk Considerations

The UITs in this brochure invest in various types of securities, which may include common stocks, preferred securities, real estate investment trusts (“REITs”), convertible securities, senior loans, high-yield bonds, municipal closed-end funds, REIT closed-end funds, mortgage-backed securities, investment grade corporate bonds, equity closed-end funds, income closed-end funds, international equity securities and/or American Depositary Receipts (“ADRs”), covered-call closed-end funds, and GNMA securities. In addition, the securities may be further classified by market capitalization, industry sector, investment style, and issuer’s country of origin. • An investment in a particular trust should be made with an understanding of the risks associated with its respective underlying securities. • Certain trusts may be concentrated in various sectors. As a result, the factors that impact the specific sector will likely have a greater effect on the specific trust than a more broadly diversified trust. • There is no guarantee that any given trust will achieve its investment objective. You can lose some or all of your investment in these trusts. The trusts might not perform as well as you expect. • Securities prices can be volatile. • The value of your investment may fall over time. • Market value fluctuates in response to various factors. These can include stock market movements, purchases or sales of securities by the trusts, government policies, litigation, and changes in interest rates, inflation, the financial condition of the securities’ issuer, or even perceptions of the issuer. • The financial condition of an issuer may worsen or its credit ratings may drop, resulting in a reduction in the value of your units. This may occur at any point in time, including during the primary offering period. • Inflation may decrease the value of money. Inflation may lead to a decrease in the value of assets or income from investments. • The sponsor does not actively manage these portfolios. • The trusts will generally hold, and may continue to buy, the same securities even though the security’s outlook, rating, market value, or yield may have changed.

Unit Investment Trusts are fixed, not actively managed and should be considered as part of a long-term strategy. Investors should consider their ability to invest in successive portfolios, if available, at the applicable sales charge. UITs are subject to annual fund operating expenses in addition to the sales charge. Investors should consult an attorney or tax advisor regarding tax consequences associated with an investment from one series to the next, if available, and with the purchase or sale of units.