Introduction to ABS

Securitization, structured products, structured credit, and ABS all refer to roughly the same thing: debt secured primarily by pools of contractual obligations to pay.

Too often, we find that reports on structured credit as an asset class rely on jargon, anecdotes, inaccurate definitions, and generalizations. Our goal is to provide a coherent description that answers the following fundamental questions: Why does securitization, the process that creates structured credit investments, exist? How does structured credit differ from traditional corporate credit, mortgage lending, or leasing? What distinguishes a “securitizable” asset from other assets such as real estate, guarantees, or equity interests? How are common features of structured credit intended to help protect debt investors? What roles do originators and servicers play? What are the benefits to the borrower? Asset-backed securities are complex investments and not suitable for all investors because these instruments are subject to many risks, including credit, liquidity, interest rate, and valuation risk1. We present this primer on securitized credit with the hope that investors can approach the sector with greater familiarity and perspective.

The Elephant in the Room

During the GFC, many investors experienced losses related to private label RMBS, CMBS, and MBS-backed collateralized debt obligations (CDOs). This dislocation exposed investors who based their investment decisions primarily on ratings, guarantees from monoline insurers, and a blind reliance on historical experience of the 2003–2006 credit boom to anchor future performance expectations, especially in housing and commercial real estate.

The illiquidity and credit losses investors experienced during this period led many to steer clear of the sector. In the aftermath of the GFC, however, the structured credit market underwent a painful yet necessary transformation: Market participants, including investors, issuers, arrangers, and rating agencies, returned to sustainable credit underwriting. Diverse, appropriately capitalized, cautious buyers stepped into the vacuum created by the disorderly departure of overly levered, correlated investors, thereby improving market liquidity and stability.

Despite these developments, losses and volatility always have the potential to return to certain corners of structured credit. Structured credit was not immune from downward ratings drift during the early stages of the COVID-19 pandemic, similar to what was experienced across other asset classes. However, structured credit in aggregate realized lower default rates in 2020 than corporate credit peers and their own historical averages. For example, CLOs did not experience a single default during all of 2020, and only five in 2021, according to S&P. This compares favorably to the high-yield bond market, which recorded default rates as high as 9 percent in August 2020, and the leveraged loan market, which recorded a default rate of 4.2 percent in September 2020.

Identifying which specific ABS types, structures, and securities may experience a dislocation requires dedicated credit, trading, technology, legal resources, and a disciplined investment process.

Inside ABS: Securitizable Assets and Contractual Cash Flows

Securitization begins with an agreement. One party agrees to pay another party. A family buys a home and agrees to monthly mortgage payments. A software company borrows capital to purchase a smaller competitor and agrees to the terms of a bank loan. A regional airline, looking to add routes, enters a lease agreement on an Airbus A320. A franchisee opens a drive-through restaurant and agrees to pay 5 percent of sales to Wendy’s Corp.

Look beyond the house, the software company, the airplane, and the restaurant. These agreements are all contractual obligations to pay that form the basic building blocks of securitization: they comprise the assets backing the securitization.

You may be the proud owner of a vast vinyl record collection. Your record collection, however, doesn’t belong in a securitization. In order to serve as the collateral backing an asset-backed security, an asset must represent a contractual obligation to make payments. In other words, the assets on the left-hand side of the securitization’s balance sheet also exist as liabilities on the right-hand side of the payer’s balance sheet. Note that we refer to a “payer,” because an asset may represent the obligation to pay by a borrower, lessee, customer, or licensee, among others. Contrary to common understanding, “hard” assets do not serve as the primary collateral for securitizations. Only contracts, such as leases, mortgages, loans, and agreements that define payment obligations create the contractual cash flows necessary for securitization.

Other sources of value, such as real estate, airplanes, or a corporate guarantee, may also be available to repay ABS investors. However, these provide only secondary security. Disciplined structured credit investors rely primarily on contractual cash flows for repayment; these other sources of value represent methods of repayment only in break-glass-in-case-of-emergency situations. Experienced and capable ABS investors seek structures and collateral that avoid direct reliance on such secondary sources of value because the history of markets has shown that the cause of a disruption in a payer’s ability to honor a contractual obligation to pay will simultaneously lead to a depreciation in the value of the related hard assets (they share a “common risk factor”).

For example, when large numbers of homeowners could not honor their mortgage payment obligations, counting on steady housing prices to support debt repayment turned out to be unrealistic. Leading up to the GFC, those who conservatively evaluated borrower ability to pay their mortgages rather than focusing upon property values generally sidestepped losses (and, in some cases, gained the insight to short the ill-constructed securitizations). Meanwhile, those investors who relied on continued home price appreciation and ignored the quality of the contractual cash flows fared poorly. We believe the specific values ascribed to real estate, companies, planes, ships, and intellectual property derive from the quality of the underlying cash flows, not the other way around.

SPVs: The Structure of Structured Credit

Securitization, the act of creating asset-backed securities, begins with the creation of a special purpose vehicle, or SPV. Think of an SPV as a company with no purpose other than to acquire assets and issue debt secured by those assets. The SPV, also called the “issuer,” purchases a specific pool of assets and simultaneously issues debt securities—the asset-backed securities—and equity interests to fund the purchase of those assets. The pool of assets is typically of one type (auto loans, aircraft leases, corporate loans, etc.), but often are comprised of diverse and numerous “payers.”

Often, but not always, the SPV issues multiple classes of debt with different priority of payment, which are called tranches. Other important steps in this securitization process include the assignment of a servicer or manager, assignment of a trustee, issuance of a rating on the issued debt tranches, and the establishment of an assortment of rules to govern the securitization. These rules dictate how the trustee distributes cash flow from the asset pool between the principal and interest due on the debt tranches and equity interests, what sort of assets the SPV can own, what to do when assets pay off early, and whether cash can be used to purchase new assets. They also prescribe what happens when things go wrong, such as when the assets do not generate enough cash, or there is a precipitous decline in their quantity and/or quality. The governing documents also establish the content of the periodic investor reports, spelling out the roles, ratings, and rules, and much more. Usually, the bond indenture serves as the governing document, but some securitizations may use a credit agreement, a trust deed, or a servicing agreement. Needless to say, navigating these documents efficiently and thoroughly requires significant experience, dedicated resources, and a disciplined investment process.

More than MBS: ABS Collateral Types Are Familiar and Diverse

At its inception in the mid-1980s, the non-mortgage ABS market began with securitizations of auto loans and credit card receivables. Since then, the sector has rapidly evolved into a highly diversified $1.6 trillion market, running the gamut of collateral types. Within structured credit, investors can construct a portfolio of various collateral types, providing additional diversification benefits at the investor portfolio level. Real estate-related securitized credit, including Agency and non-Agency RMBS and CMBS, technically represent types of ABS, but their investment considerations differ significantly enough that we consider them distinct asset classes. Non-real estate ABS collateral types can be grouped into two main subsectors, consumer and commercial:

- Consumer ABS are backed by cash flows from personal financial assets, such as student loans, credit card receivables, and auto loans.

- Commercial ABS are constructed from pools of receivables, loans, or leases on assets, such as shipping containers, data centers, aircraft, and other commercial equipment. Commercial ABS also include collateralized loan obligations (CLOs) backed by corporate bank debt or commercial real estate loans, and, on occasion, collateralized bond obligations (CBOs) backed by high-yield bonds.

Other non-mortgage securitized assets include merchant credit card advances, oil and gas future production royalty agreements, commission agreements, drill-ship charter agreements, property assessed clean energy loans, wireless tower leases, billboard leases, consumer wireless contracts, and wireless spectrum agreements. For a more comprehensive list of ABS types, see Appendix A.

Investor-Friendly Features of Securitized Credit

ABS include investor-friendly features intended to help protect against loss and improve liquidity, including bankruptcy remoteness, excess spread and triggers, overcollateralization, diversity of payers, amortization, and debt tranching.

Bankruptcy remoteness: Most securitizations involve a sponsor, typically a lender, specialty finance company, institutional investor, or corporation. If that sponsor gets into financial trouble, it can usually file for protection of its assets from creditors under the bankruptcy code, forcing all creditors into a standstill. However, in a securitization, the SPV that issues the debt is separate and distinct from the sponsor. Bankruptcy protection for the sponsor does not extend to the liabilities of the SPV. Further, the assets of SPV will not be available to the sponsor’s other creditors, providing ABS investors with a layer of protection from financial stress experienced by the sponsor.

Excess spread and triggers: As illustrated below, the expected yield or return of the underlying asset pool usually exceeds the average yield of the issued ABS debt.

In the normal course, excess spread cash flow goes to the SPV’s equity investors. However, in the event of deterioration in the quality and/or quantity of the underlying loan pool, ABS may breach a “trigger.” In CLOs, for example, a breached trigger will require that excess spread be diverted away from the equity investors to either repay principal of the CLO’s most senior tranche or to purchase additional collateral. If pool performance deteriorates further, triggers may also require that interest be diverted away from junior debt tranches to repay the senior-most tranche. As such, excess spread serves as a cushion for debt investors. It is important to note that not all types of securitizations have excess spread.

Focusing exclusively on overcollateralization or LTV, particularly when the securitized assets do not have explicit principal amounts, is insufficient credit analysis. In a market in which debt capital is readily available and credit losses are low, more favorable debt terms tend to fuel increased appraisals and calculated present values over time. Cheap debt increases hard asset values as firms enjoy a lower cost of funds and consequently have lower hurdle rates for investments, thereby bidding up asset prices. ABS investors observe higher hard asset values, point to additional overcollateralization, and extend more cheap debt, which increases appraisals further, and so on. Engineers refer to this circular reference as a “positive feedback loop,” an inherently unstable condition.

Diversity of payers: Most securitizations, regardless of type, have pools of loans, leases, or other contractual cash flows with many unique underlying borrowers or lessees (collectively “payers”). A CLO’s underlying portfolio may contain over a hundred unique corporate borrowers. A shipping container lease ABS pool may include dozens of cargo shipping line operators as lessees. A credit card ABS master trust may include receivables from thousands of individual card holders. An aircraft lease ABS may include leases representing obligations of many different airlines. By design, ABS debt investors do not require every underlying payer to perform in order for the ABS debt to receive all principal and interest payments. This diversification is intended to help protect against a loss arising from the idiosyncratic default risks associated with individual payers.

Tranching of risk and amortization: Generally, securitizations issue multiple tranches, or classes of debt, that customize risk, rating, timing of repayment, and lien seniority on the collateral. This tranching allows debt with diverse risk and reward characteristics to be created from a single pool of assets. The shorter maturity, more senior tranches carry higher ratings, and greater cushion against loss, while the longer-dated, more junior tranches have higher yields but carry lower ratings. In this way, tranching serves to create debt that will suit different investor preferences. Tranching is achieved in a securitization through a set of rules defining the priority of payments—commonly referred to as a waterfall—that is the backbone of any securitization’s governing document. While tranching represents a major benefit of securitization, excessive customization may adversely impact liquidity and, in extreme cases, maybe be correlated with excessive investor confidence in the expected performance of the asset class. In practice, within each ABS subtype, we see standardized tranching, or “capital structures,” that allow market participants to more efficiently develop bids and offers in secondary markets.

Professional servicing and active management: The servicer, also referred to as the collateral manager, seeks to maximize the certainty and quantity of cash flows from the underlying pool of assets. Responsibilities of the servicer may include evaluating credit quality of payers and assets prior to inclusion in the pool, negotiating pricing and terms of loans and leases, remarketing equipment for lease, negotiating with nonperforming lessees or borrowers, obtaining appraisals, and selling hard assets. In many transactions, the servicer or an affiliate owns the equity or residual interest in the securitization, which generally creates a favorable alignment of interest with the debt investors. A major distinction exists between static pools and actively managed pools. In static pools, cash flows from the collateral may not be reinvested in new collateral. In actively managed, or reinvesting, securitizations, the manager may purchase new assets with proceeds received from existing assets, subject to strict eligibility criteria.

Investment-grade ratings: Securitizations represent a bankruptcy remote lien on diverse, contractually cash flowing assets, and consequently rating agencies generally assign investment-grade ratings to many of the issued debt tranches. However, the repayment of debt relies on contractual cash flows and does not generally benefit from recourse to the sponsor or asset originator. As a result, securitized debt ratings rely heavily on those contractual cash flows, many of which can persist for many years irrespective of the success or failure of the sponsor’s business plan. Accordingly, even though most securitizations are expected to mature within one to 10 years’ time, rating agencies often commit to supporting investment-grade ratings for periods of over 20 years on bonds with a combination of long-term collateral cash flows and structural protections that should provide for principal recovery even in adverse or recessionary periods.

Professional reporting: Each securitization employs a third-party trustee that, among other responsibilities, distributes periodic performance reports to investors. These reports, generally prepared by the servicer, relay information about the underlying collateral’s composition, quality, and payment performance. While the content of the reports varies by securitization type, in each case these reports meaningfully contribute to liquidity and facilitate risk management, as they allow existing and prospective investors to evaluate the performance and outlook of the securitization.

ABS: What’s In It for the Borrower?

Securitizations provide debt capital to two types of borrowers: They may fund the loans or leases originated by lenders, lessors, or other specialty finance companies. Alternatively, securitizations may provide debt capital to traditional corporate borrowers who have contracts or own assets that are of higher financial quality than their own full faith and credit.

For all borrowers, a benefit of securitization is that the term of ABS borrowing matches the term of the underlying assets, insulating them from mark-to-market or refinancing risks. From the traditional corporate borrower’s perspective, the benefits of financing through securitization include:

- Term of financing matches tenor of assets, reduces refinancing risk, and eliminates potential for forced asset sales

- Lower borrowing costs than alternatives such as senior unsecured bonds

- Non-recourse to the sponsor, may provide off-balance sheet treatment

- Diversity of funding sources may improve enterprise valuation for sponsor

In each case, borrowers pledge loans, leases, or other securitizable assets as collateral that exceeds the same borrower’s intrinsic creditworthiness. In other words, the securitization investor tables the difficult question, “Will the borrower repay me?”—indeed, payments are not guaranteed by the corporation—and instead asks the simpler question: “Will these assets (loans, leases, etc.) generate enough contractual cash flow to repay me?”

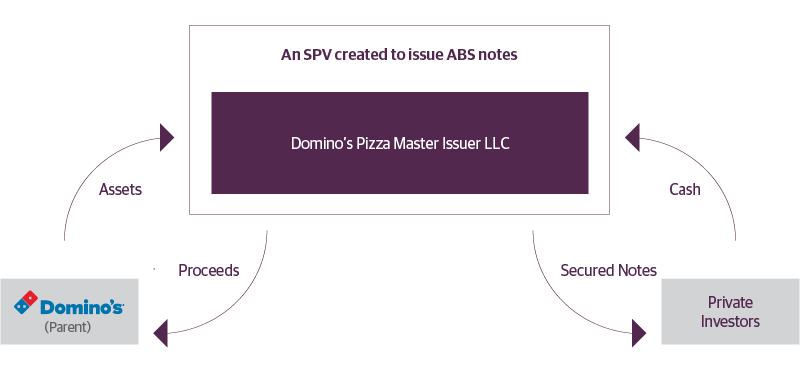

The following case study illustrates the benefits of securitization to a traditional corporate borrower. This $2 billion securitization by Domino’s Pizza employed the basic structure, mechanics, and priority of payments for ABS. In contrast to multi-tranche ABS structures, this securitization is characterized by a single-term tranche of debt and a pari-passu (equal rank to the term tranche) revolver backed by the same assets.

Securitization Case Study: Domino’s Pizza3

Domino’s Pizza, one of the largest pizza restaurant chains in the world, accessed the securitization market to finance its businesses. As part of the transaction, Domino’s established a bankruptcy remote SPV into which it sold substantially all of its revenue-generating assets. The SPV financed the acquisition of these assets by issuing ABS.

How Securitization Served as the Optimal Financing Solution for Domino’s

Founded in 1960, Domino’s currently has over 20,000 restaurant locations globally. Domino’s primarily operates as a franchisor of its brand, where almost all of its stores are owned and operated by franchisees.

In the franchise model, Domino’s (as the franchisor) grants a store owner/operator the right to operate using all of Domino’s intellectual property in consideration for an upfront license fee and an ongoing sales royalty. By paying the fees and royalties, the store operator benefits from Domino’s brand, store look and design, menu, ingredient sourcing network, information technology, and advertising campaigns. From Domino’s perspective, the franchisees shoulder the cost of expanding the chain’s footprint while providing Domino’s with a stable stream of royalty payments.

The stability of the royalty payments comes from the fact that franchisees pay Domino’s a fixed percentage of stores sales, not profits, therefore removing the risk of decreasing franchisee operating margins. The stability and predictability of the royalty payment streams, combined with the value of Domino’s intellectual property, allowed Domino’s to access the structured credit markets and issue investment-grade debt. Below we describe in summary the steps the company took to achieve its goals:

- Domino’s created an SPV, called Domino’s Pizza Master Issuer LLC, into which it sold its revenue-generating assets. These assets include existing and future franchise agreements, existing and future intellectual property, franchisor-owned store royalties, supply-chain business segment real estate and operational profits, and SPV transaction accounts.

- The SPV issued ABS notes to finance the purchase of the acquired assets. The SPV pledges its assets as collateral for the benefits of noteholders to secure its repayment obligations.

- Domino’s entered into a management agreement with the SPV, which essentially requires it to continue operating the business on a daily basis as franchisor.

- Domino’s retains a substantial equity interest in the SPV and is permitted to collect cash flows in excess of required ABS noteholder payments. Domino’s retained equity aligns its interest with that of ABS noteholders; both benefit from a well-performing business. Details below describe how performance triggers within the securitization help protect noteholders by redirecting excess cash flow away from Domino’s and to the ABS.

- In the event Domino’s were to default on a non-ABS obligation, any such creditor would be subordinate to all ABS investors in right, title, and claim to the SPV’s assets.

How Credit Enhancements Help Protect ABS Investors

Notes issued under an ABS transaction are wholly backed by the assets owned by the SPV, but what happens if the cash flows generated by those assets diminish? As noted earlier, ABS transactions often carry several structural protections to help protect the bondholders from losses. Domino’s ABS include a number of such structural protections:

- Required Amortization. Domino’s is required to repay a set amount of the original debt annually while maintaining enough leverage to incrementally reduce dollars at risk for debt investors.

- Performance triggers. Two performance triggers in the Domino’s securitization serve to help protect the ABS investor. Both tests are used to redirect cash from Domino’s to either hold in a reserve account or repay debt in the event that business performance deteriorates:

- Cash trap requires excess cash flows to be diverted from equity to a reserve account if the debt service coverage ratio or system-wide annual sales decline below specified test levels.

- Rapid amortization diverts all excess cash flow from the equity (owned by Domino’s) to repay the ABS. Rapid amortization is triggered under various conditions, including further debt service coverage ratio or sales declines, failure to repay the loan by a certain date, or if Domino’s declares bankruptcy.

ABS Structure Aligns Domino’s Interests with Investors

Domino’s retention of equity in the SPV means both the ABS investors and Domino’s gain from a well-performing franchise.

Important Notices and Disclosures

1. Asset-backed securities are complex investments and not suitable for all investors. Investors in asset-backed securities generally receive payments that are part interest and part return of principal. These payments may vary based on the rate loans are repaid. Some asset-backed securities may have structures that make their reaction to interest rates and other factors difficult to predict, making their prices volatile and they are subject to liquidity and valuation risk. Please see “Important Notes and Disclosures” at the end of this document for additional risk information.

2. Investors in asset-backed securities may be subject to other types of risks. Please see the end of the document for risks related to this asset class.

3. This case study is for illustrative purposes only to show the structure of an asset-backed security and should not be considered as investing advice or a recommendation. The Domino’s Pizza example was chosen for its relatively simple structure and its recognizable brand name. Guggenheim Securities, LLC, part of Guggenheim Partners, LLC, served as an underwriter for the security.

The Bloomberg U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, USD-denominated, fixed-rate taxable bond market. The index includes Treasurys, government-related and corporate securities, MBS (Agency fixed-rate and hybrid ARM pass-throughs), ABS, and CMBS (Agency and non-Agency).

The Bloomberg U.S. Corporate Bond Index measures the investment grade, fixed-rate, taxable corporate bond market. It includes USD-denominated securities publicly issued by U.S. and non-U.S. industrial, utility, and financial issuers.

The ICE BofA AA-BBB U.S. Fixed-Rate Asset Backed Index is the AA-rated to BBB-rated subset of the ICE BofA U.S. Fixed-Rate Asset Backed Securities Index, which tracks the performance of USD-denominated investment-grade fixed-rate asset backed securities publicly issued in the U.S. domestic market.

The J.P. Morgan Collateralized Loan Obligation Index is a total return benchmark for broadly syndicated arbitrage U.S. CLO debt comprising U.S. dollar denominated broadly syndicated arbitrage CLOs.

Past performance is not indicative of future results.

Investing involves risk, including the possible loss of principal. Investments in fixed-income instruments are subject to the possibility that interest rates could rise, causing their values to decline. Asset-backed securities are complex investments and not suitable for all investors. Investors in asset-backed securities, including collateralized loan obligations (“CLOs”), generally receive payments that are part interest and part return of principal. These payments may vary based on the rate loans are repaid. Some asset-backed securities may have structures that make their reaction to interest rates and other factors difficult to predict, making their prices volatile and they are subject to liquidity and valuation risk. CLOs bear similar risks to investing in loans directly, such as credit, interest rate, counterparty, prepayment, liquidity, and valuation risks. Loans are often below investment grade, may be unrated, and typically offer a fixed or floating interest rate. High yield and unrated debt securities are at a greater risk of default than investment grade bonds and may be less liquid, which may increase volatility.

This material is distributed or presented for informational or educational purposes only and should not be considered a recommendation of any particular security, strategy or investment product, or as investing advice of any kind. This material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. The content contained herein is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

This material contains opinions of the author, but not necessarily those of Guggenheim Partners, LLC or its subsidiaries. The opinions contained herein are subject to change without notice. Forward looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information.

© 2024, Guggenheim Partners, LLC. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Guggenheim Partners, LLC.

Guggenheim Funds Distributors, LLC an affiliate of Guggenheim Partners, LLC. For more information, visit guggenheiminvestments.com or call 800.345.7999.

GIBRO-ABS-ABC 0724 61609

©

Guggenheim Investments. All rights reserved.

Guggenheim Investments represents the following affiliated investment management businesses of Guggenheim Partners, LLC: Guggenheim Partners Investment Management, LLC, Security Investors, LLC, Guggenheim Funds Distributors, LLC, Guggenheim Funds Investment Advisors, LLC, Guggenheim Corporate Funding, LLC, Guggenheim Wealth Solutions, LLC, Guggenheim Private Investments, LLC, Guggenheim Partners Europe Limited, Guggenheim Partners Japan Limited, and GS GAMMA Advisors, LLC,.