Summary

Collateralized loan obligations (CLOs) are typically a high yielding, scalable, floating-rate investment alternative to corporate bonds with a history of stable credit performance. CLOs represent a $1.4 trillion asset class within the broader $13.3 trillion structured credit fixed-income market—which also includes asset-backed securities (ABS) and mortgage-backed securities (MBS), among other similar securities—and derive principal and interest from an actively managed, diversified pool of non-investment grade, senior-secured corporate loans.

These loans, also known as bank loans or leveraged loans, typically occupy a first-lien position in the company’s capital structure. They are secured by the borrower’s assets, and rank first in priority of payment ahead of unsecured debt in the event of bankruptcy.

CLOs’ combination of diversified, actively managed, senior-secured loan collateral, along with robust securitization structures, has resulted in historically strong ratings performance and low default rates across the credit ratings spectrum, comparing favorably to corporate debt.

Investing in CLOs is not without risk. As with other securities, CLOs are subject to credit, liquidity, and mark-to-market risk. The basic architecture of CLOs requires that investors must understand the order in which the cash flows from the underlying portfolio are distributed to investors, known as waterfall mechanisms, as well as the protections, terms, conditions, and credit profile of the loan collateral.

Still, CLOs have several features that make them an integral component of Guggenheim’s fixed-income strategies. One of the most important characteristics of CLOs is their floating-rate coupon, making their price less sensitive to changes in interest rates.

Report Highlights

- CLOs represent a high yielding, scalable, floating-rate investment alternative with a history of stable credit performance.

- Solid credit performance through the Global Financial Crisis (GFC) and COVID-19 risk cycles has supported growth in the CLO market, broadened the investor base, and supported secondary market liquidity.

- Guggenheim Investments’ long-term experience mobilizing credit research, structural analysis, analytical infrastructure, and legal expertise positions us to potentially capture the attractive relative and fundamental value in CLOs throughout a cycle.

Overview: What Are CLOs?

CLOs are a $1.1 trillion asset class within the broader $13.3 trillion structured credit fixed-income market1, which also includes ABS and MBS. CLOs derive principal and interest from an actively managed, diversified pool of non-investment grade, senior-secured corporate loans.

CLOs issue debt and equity to investors and use the funds to acquire a diverse portfolio typically comprising more than 200 loans. The debt is divided into tranches with varying risk and return profiles, determined by their seniority and priority in receiving cash flows from the loan pool.

These underlying loans, also known as bank loans or leveraged loans, typically hold a first-lien position in the company’s capital structure, are secured by the company’s assets, and rank first in priority of payment ahead of unsecured debt in the event of bankruptcy. Economically, CLO equity investors own the loan pool, while the CLO debt investors provide term financing to acquire the pool of loans.

The CLO’s most senior and highest-rated AAA tranche carries the lowest coupon but is entitled to the highest claim on the cash flow distributions and is the most loss-remote. Mezzanine tranches pay higher coupons but are more exposed to loss and have lower ratings. The most junior and riskiest part of the CLO capital structure is the equity tranche, which is neither rated nor coupon bearing. Instead, the equity tranche represents a claim on all excess cash flows that remain once the obligations for all debt tranches have been met. In a typical CLO structure, the AAA senior tranches are the largest, usually comprising around 65 percent of the capital structure. Mezzanine tranches, rated AA to BB-rated, are much smaller, usually making up 4–12 percent each. The equity tranche, which absorbs initial credit losses, varies in size but typically accounts for about 8–10 percent of the capital structure.

CLOs are governed by a series of coverage tests that measure the adequacy of the collateral balance and the cash flows generated by the underlying bank loans. One such test is an overcollateralization test (OC test), which ensures the principal value of the loan pool exceeds the outstanding principal of the CLO debt tranches. If the collateral’s principal value falls below the OC test trigger, cash that would have gone to the equity and junior tranches is instead redirected to pay down senior debt. Another test computes interest coverage (IC test), which ensures sufficient interest income to cover CLO tranche payments. If interest collections decline below the IC test trigger, cash is similarly diverted from equity and junior tranches to senior debt tranche investors.

CLOs are also subject to various collateral concentration limits designed to minimize risk in the bank loan collateral pool and protect CLO investors from loss. These limits include requirements for industry diversification in the loan pool, caps on exposure to non-senior secured loans and single obligors, and limitations on the share of CCC-rated loans, helping contain overall default risk.

Most CLO portfolios are actively managed. Over a defined reinvestment period, the collateral manager seeks to mitigate losses from loan defaults and optimize the bank loan portfolio’s value by actively managing the portfolio’s holdings. CLOs are not subject to mark-to-market tests and rely solely upon cash flow performance—or the timely payment of principal and interest—ratings, maturities, and defaults. As a result, CLO managers are not forced sellers during periods of market volatility and can actively trade loans to capture value or minimize losses on deteriorating credits.

Comparing Middle Market and Broadly Syndicated CLOs

While most CLOs are backed by broadly syndicated loans (BSL), a smaller but growing segment of the market is middle market (MM) CLOs—also referred to as private credit (PC) CLOs. MM CLOs are tied to the expanding private credit markets, where non-bank lenders such as private debt funds, business development companies (BDCs), and insurance companies provide loans directly to companies, bypassing the bank loan syndication process.

BSL CLOs are backed by loans to larger borrowers, typically with earnings before interest, taxes, depreciation, and amortization (EBITDA) greater than $250 million, and held by multiple lenders (i.e. syndicated). In contrast, MM CLOs are backed primarily by private, directly originated loans to small and medium-sized borrowers, typically with EBITDA between $50–$100 million, and often containing tighter documentation. Some MM CLO managers also specialize in loans to larger borrowers, with EBITDA greater than $100 million, blurring the line between middle market and broadly syndicated loans as private credit becomes more accessible to larger companies.

Historically MM CLO issuance accounted for 10–12 percent of overall CLO issuance, but in recent years this figure rose to as high as 24 percent. Currently, MM CLOs represent 12.4 percent of the total CLO amount outstanding, double the percentage from a decade ago.

Collateral quality is a key differentiator between BSL and MM CLOs, as MM CLOs have much greater CCC-rated exposure. Due to the poorer credit quality of the underlying collateral, MM CLOs offer higher credit enhancement relative to BSL for similarly rated tranches, such as overcollateralization, to help offset the risk. Middle market loans also tend to have higher spreads and are usually assigned a private credit estimate rather than a public rating. Liquidity is another major distinction between the two markets, as the underlying collateral of BSL CLOs is much more liquid, with greater pricing transparency, than the collateral of MM CLOs.

Due to the poorer credit quality of the underlying collateral, MM CLOs offer higher credit enhancement relative to BSL for similarly rated tranches, such as overcollateralization, to help offset the risk. Middle market loans also tend to have higher spreads and are usually assigned a private credit estimate rather than a public rating.

Breaking Down a CLO’s Lifecycle

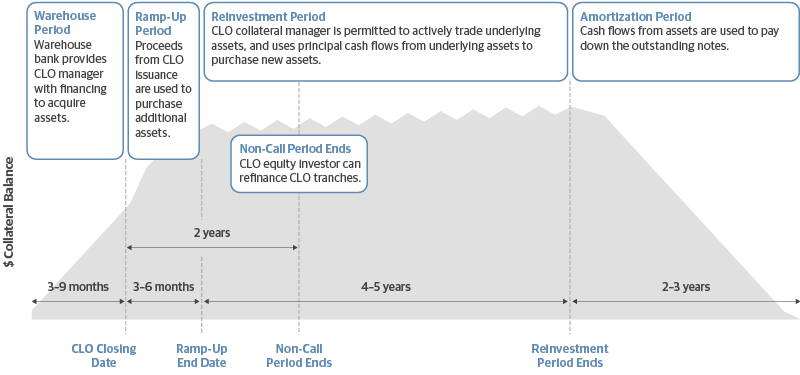

The lifecycle of a CLO typically lasts eight to 10 years, during which time a series of milestones are passed.

Warehouse Period: A warehouse provider finances the CLO manager’s acquisition of leveraged loan assets. The warehouse period typically takes three to nine months. The warehouse loan is expected to be paid off with the proceeds from the CLO’s issuance.

Ramp-Up Period: After closing, the CLO manager uses the proceeds from the CLO issuance to purchase additional assets. The ramp-up period usually lasts three to six months and concludes at the ramp-up end date.

Reinvestment Period: The collateral manager is permitted to actively trade underlying assets within the CLO and uses principal cash flow from underlying assets to purchase new assets. The reinvestment period may last up to five years.

Non-Call Period: During the non-call period the equity may not call or refinance the CLO debt tranches. Non-call periods may last six months to two years, depending on the length of the reinvestment period. After that point, CLO equity tranche owners have the right, but not the obligation, to refinance the CLO.

Amortization Period: After the reinvestment period ends, the CLO enters its amortization period, during which cash flows from the CLO’s underlying assets are used to pay down outstanding CLO debt. The amortization period represents the end of a CLO’s lifecycle.

Lifecycle of a CLO

Source: Guggenheim Investments, Wells Fargo.

Investor Sponsorship

The CLO marketplace has grown significantly since the GFC, rising from a post-crisis trough of $263 billion to $1.4 trillion as of April 2025, according to Bank of America data. Strong historical credit performance and floating-rate coupons attracted many new investors. The CLO market has grown in step with the bank loan market and outpaced growth in other credit sectors. CLOs purchased 61 percent of all new issue leveraged loans in 2024, and own 64 percent of the overall leveraged loan market.

Prior to the GFC, investor sponsorship was dominated by hedge funds, structured investment vehicles, and Wall Street trading desks—entities that relied heavily on leverage. Post-crisis regulation has all but eliminated these players from the market. Today’s CLO investor base is primarily composed of large institutional asset managers, banks, and insurance companies, which use far less leverage and are therefore less vulnerable to the forced selling driven by mark-to-market volatility and margin calls.

Investing in CLOs

CLOs have several features that make them an integral component of Guggenheim Investments’ fixed-income strategies. In addition to their investor-friendly structural protections and historical credit performance, one of the most important characteristics of CLOs is their floating-rate coupon, which helps insulate bond prices from volatile interest rates. Fixed-rate securities decline in value as interest rates rise and investors discount the value of the fixed-rate bonds’ relatively low coupons. However, the coupons on floating-rate securities such as CLOs adjust based on the current short-term interest-rate environment. As a result, floating-rate securities’ prices tend to be more stable in volatile interest-rate environments than those of their fixed-rate counterparts.

Investing in CLOs is not without risk. As with other securities, CLOs are subject to credit, liquidity, and mark-to-market risk, and investors must understand the waterfall mechanisms and protections as well as the terms, conditions, and credit profile of the underlying loan collateral. Thus, the relative value determination for a CLO simultaneously considers potential returns relative to other securitized and corporate fixed-income sectors as well as its pricing relative to other short-duration options.

Capturing opportunities in the CLO market requires the expertise to perform bottom-up research on individual bank loans in the underlying collateral pool. Because CLOs routinely have over 200 issuers in their collateral pools, investment managers must have significant corporate credit research capabilities to fully evaluate the underlying credit risk in each CLO.

The importance of understanding a CLO’s structural characteristics cannot be underestimated. Two CLOs with the identical collateral assets may perform differently due to structural differences. The legal documentation that governs a typical CLO can be more than 300 pages, and a high degree of expertise and consistent market presence are required to analyze these documents and discuss key terms with managers looking to access the market. The ability to access the value in CLOs becomes available to investors with the appropriate mix of credit research, structuring experience, and legal expertise.

The Guggenheim Approach

Guggenheim Investments’ approach to investing in CLOs is consistent with our process for all our fixed-income investments. With CLOs, the investment process starts with a bottom-up fundamental approach to CLO structures. Guggenheim brings to bear its extensive research insights across a broad spectrum of the bank loan market and the structuring and legal expertise necessary to understand the nuances of each individual CLO investment opportunity. Collateral, structure, and manager attributes are evaluated, and stress testing and scenario analyses are performed. Research is augmented by our in-house legal team and by the obligor-level credit views of our corporate credit team. Investments are integrated into portfolio strategies by considering relative value, risk, and sector targets, as well as the risk-adjusted return potential evaluated from a long-term holding period point of view.

Important Notices and Disclosures

1. Source: Guggenheim Investments, SIFMA, JP Morgan, Bank of America. Data as of 12.31.2024. CLOs are complex investments and not suitable for all investors. Investors in CLOs generally receive payments that are part interest and part return of principal. These payments may vary based on the rate at which loans are repaid. Some CLOs may have structures that make their reaction to interest rates and other factors difficult to predict, make their prices volatile, and subject them to liquidity and valuation risk. Please see “Important Notes and Disclosures” at the end of this document for additional risk information.

Glossary of Terms

Basis Point: A unit of measure used to describe the percentage changes in the value or rate of an instrument. One basis point is equivalent to 0.01 percent.

First Lien: A security interest in one or more assets that lenders hold in exchange for secured debt financing. The first lien to be recorded is paid first.

Mark-to-Market: A measure of the fair value of an asset or liability, based on current market price.

Mezzanine Financing: A hybrid of debt and equity financing that is typically used in the expansion of existing companies.

Second Lien: Debts that are subordinate to the rights of more senior debts issued against the same collateral or portions of the same collateral.

Secured Overnight Financing Rate (SOFR): A broad measure of the cost of borrowing cash overnight collateralized by Treasury securities.

Structured Investment Vehicles: Pools of investment assets that attempt to profit from credit spreads between short-term debt and long-term structured finance products such as asset-backed securities.

Tranche: Related securities that are portions of a deal or structured financing, but have different risks, return potential and/or maturities.

Waterfall: A hierarchy establishing the order in which funds are to be distributed.

This material is distributed or presented for informational or educational purposes only and should not be considered a recommendation of any particular security, strategy or investment product, or as investing advice of any kind. This material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. The content contained herein is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

Private debt investments are generally considered illiquid and not quoted on any exchange; thus they are difficult to value. The process of valuing investments for which reliable market quotations are not available is based on inherent uncertainties and may not be accurate. Further, the level of discretion used by an investment manager to value private debt securities could lead to conflicts of interest.

This material is distributed or presented for informational or educational purposes only and should not be considered a recommendation of any particular security, strategy or investment product, or as investing advice of any kind. This material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. The content contained herein is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

This material contains opinions of the author or speaker, but not necessarily those of Guggenheim Partners, LLC, or its subsidiaries. The opinions contained herein are subject to change without notice. Forward-looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information. No part of this material may be reproduced or referred to in any form, without express written permission of Guggenheim Partners, LLC.

Investing involves risk, including the possible loss of principal. Investments in bonds and other fixed-income instruments are subject to the possibility that interest rates could rise, causing their value to decline. Investors in asset-backed securities, including mortgage-backed securities, collateralized loan obligations (CLOs), and other structured finance investments, generally receive payments that are part interest and part return of principal. These payments may vary based on the rate at which the underlying borrowers pay off their loans. Some asset-backed securities, including mortgage-backed securities, may have structures that make their reaction to interest rates and other factors difficult to predict, causing their prices to be volatile. These instruments are particularly subject to interest rate, credit and liquidity and valuation risks. High yield bonds may present additional risks because these securities may be less liquid, and therefore more difficult to value accurately and sell at an advantageous price or time, and present more credit risk than investment-grade bonds. The price of high yield securities tends to be subject to greater volatility due to issuer-specific operating results and outlook and to real or perceived adverse economic and competitive industry conditions. Bank loans, including loan syndicates and other direct lending opportunities, involve special types of risks, including credit risk, interest rate risk, counterparty risk, and prepayment risk. Loans may offer a fixed or floating interest rate. Loans are often generally below investment grade, may be unrated, and can be difficult to value accurately and may be more susceptible to liquidity risk than fixed-income instruments of similar credit quality and/or maturity.

© 2025, Guggenheim Partners, LLC. All rights reserved. Guggenheim, Guggenheim Partners, and Innovative Solutions. Enduring Values. are registered trademarks of Guggenheim Capital, LLC. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Guggenheim Partners, LLC.

65451

©

Guggenheim Investments. All rights reserved.

Guggenheim Investments represents the following affiliated investment management businesses of Guggenheim Partners, LLC: Guggenheim Partners Investment Management, LLC, Security Investors, LLC, Guggenheim Funds Distributors, LLC, Guggenheim Funds Investment Advisors, LLC, Guggenheim Corporate Funding, LLC, Guggenheim Wealth Solutions, LLC, Guggenheim Private Investments, LLC, Guggenheim Investments Loan Advisors, LLC, Guggenheim Partners Europe Limited, Guggenheim Partners Japan Limited, and GS GAMMA Advisors, LLC.